Legal Insurance in Germany: Coverage, Costs, and Claims Process Explained

Legal insurance in Germany (Rechtsschutzversicherung) can provide peace of mind and financial protection in case of unexpected legal issues. This guide will cover the basics of legal insurance, including what it covers, how much it costs, and how to file a claim. Whether you're a resident or planning to move to Germany, understanding legal insurance can help you navigate the legal system with confidence.

DISCLOSURE: This post contains affiliate links. This means that, at no cost to you, the Black Forest Family may earn a commission if you click through to make a purchase. To learn more, please read our disclosure for more information.

Quick Comparison of the Best Legal Insurance in Germany

For those seeking legal insurance in Germany, there are several top companies to consider. These include GetSafe, Feather, & Adam Riese. Each of these companies offers a range of coverage options and benefits to help protect individuals and their families in the event of legal issues.

GetSafe

Starting at €15.12/month, If you're looking for legal insurance in Germany that's easy to use and offers unlimited coverage, consider GetSafe. Their app and customer support are available in English, and you can cancel anytime. The coverage is exceptionally clear and easy to navigate.

100% English 24/7 support, 1 simple plan with add-ons for home and criminal protection.

Feather

Starting at €17.74/month, 100% English support, 2 plans available, varying waiting period depending on the claim, cancel monthly. Go here to get a quote in 3 minutes and review their up to date information.

Adam Riese

Starting at €14.84/month, Adam Riese is the least expensive legal insurance of the three. It is fully in German but can be fully customized to fit your needs and has outstanding support.

Go here to get a quote at Feather.

Click here to get a quote at Getsafe

Go here to get a quote from Adam Riese.

What is Legal Insurance?

In Germany, legal insurance (Rechtsschutzversicherung) is a type of insurance that provides coverage for legal expenses, including court fees and lawyer fees, in the event that you are sued or need to sue someone.

If you take someone to court or someone takes you, you would typically have to cover your legal expenses. With legal insurance, you’re covered. Even if you lose.

Additionally, some policies may also cover the cost of assessors and mediation. This type of insurance can help protect individuals from the high costs associated with legal proceedings. Legal Insurance in Germany can cover a broad range of unexpected problems ranging from a traffic offense to a landlord dispute to a criminal case.

You can often talk to a lawyer for free, who can also write letters for you, and then can help you sue someone if the letter is ineffective.

Why Should I buy Legal Insurance in Germany?

Navigating the legal system in a foreign country can be daunting, especially for expats in Germany. To avoid any potential misunderstandings or legal issues, many expats opt for legal insurance. With this insurance, expats and immigrants can have peace of mind knowing that they have access to legal assistance and support when they need it.

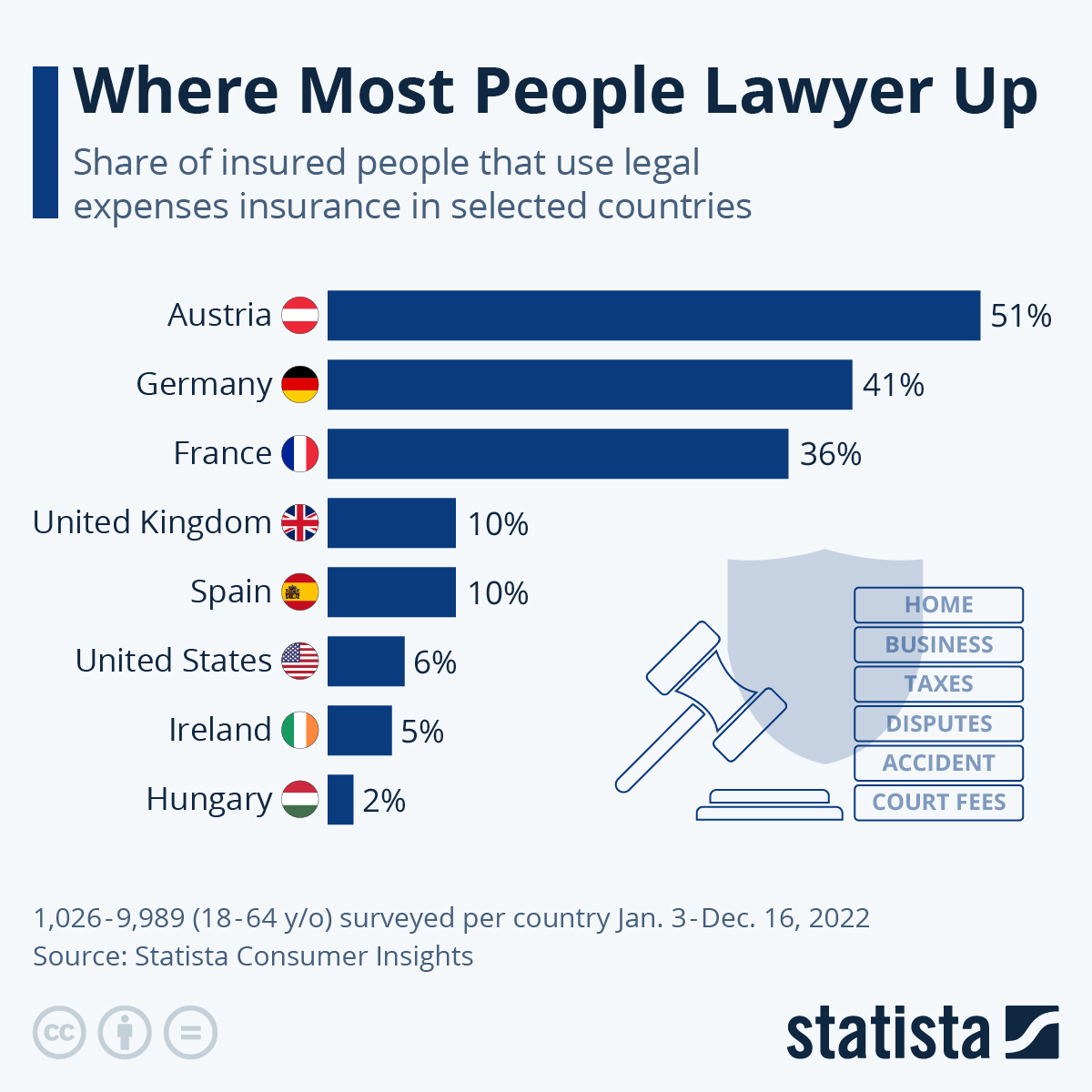

While personal liability and health insurance are considered the most important types of insurance in Germany, legal insurance is still a popular choice among Germans, with 41% of the population opting for it (according to a 2020 survey). Even more surprisingly, the same survey says that 64% of the respondents with this type of insurance actually use it.

You will find more infographics at Statista

You will find more infographics at Statista

It’s a popular option for those who value their rights and want to ensure they are protected in case of legal disputes. Germans have a strong focus on order and correct procedures, which can often lead to a lot of paperwork and legal processes. This typically comes at a legal costs.

Legal insurance in Germany for a foreigner can be a huge lifesaver due to the exceptional risk of misunderstandings and the resultant disputes. Not to mention the language barriers which make these conversations even more difficult.

This can protect you against arguments with your landlord or your neighbors hedges overgrowing into your property. Rather than trying to tackle the situation yourself, lawyer insurance will cover the costs to fight for you.

Dealing with neighbors is a simple example, but lawyer insurance in Germany can expand to many different areas. Quick examples, more details further down:

Neighbor disputes

Traffic violations

Landlord disputes

Private legal issues

Professional legal issues

Internet protection

Purchase of real estate

Home rental legal insurance

Disputes with authorities

Criminal protection

How Does Legal Insurance Work?

Legal insurance in Germany is a type of insurance that provides coverage for legal expenses. It works similarly to other types of insurance, such as health insurance, liability insurance, dental insurance, dog insurance or car insurance, in that it protects you from unexpected costs and provides peace of mind.

With legal insurance, you can seek legal advice and representation from an attorney when you find yourself in a legal situation. To use your legal insurance, you simply need to file a claim and the insurance company will handle the expenses.

This type of insurance can be especially helpful in Germany, where legal issues can arise unexpectedly, and legal fees can be quite high.

The Benefits of Having Legal Insurance?

Legal insurance in Germany offers a range of benefits, including coverage for legal fees and expenses related to disputes or legal proceedings.

Some common benefits of legal insurance in Germany include access to legal advice and representation, coverage for court costs and attorney fees, and protection against unexpected legal expenses.

It gives you assurance that your rights will be protected.

What Does Legal Insurance Cover?

Legal insurance in Germany can protect individuals in a variety of legal disputes, such as those related to labor, contracts, family law, consumer protection, and even divorce in some cases. The coverage is broad, see our examples below of how you could be protected.

Traffic Violations & Car Issues (Verkehrsrechtsschutz)

Here are some examples of how this legal insurance can protect you when driving and other vehicle related issues:

Access to legal advice and representation if you receive a parking ticket or face other legal issues related to parking. Maybe you couldn’t find a no parking sign but still got a ticket?

Disputes with authorities regarding a withdrawal of driver’s license or administrative fines.

In the event of a collision, legal insurance can help protect drivers from false accusations.

If you are in a collision and are found to be at fault, a lawyer can help minimize the penalties or consequences.

Disputes with insurance companies.

If you’re in an accident and not at fault, insurance can help you receive claims for damages and compensation for any pain and suffering experienced.

Legal insurance in Germany can be incredibly helpful when it comes to dealing with issues related to buying a car. Whether you're facing disputes with car dealers, warranty claims, or repairs, having legal insurance can provide you with the support and resources you need to navigate these challenges with confidence.

Landlord Disputes (Mietrechtsschutz)

Legal insurance can provide peace of mind for renters who may face disputes with their landlords. For example:

Attempting to evict without a valid reason.

Refusing to return a deposit.

Rent increase.

Utility costs.

This can be particularly helpful for tenants who may not have a full understanding of their housing rights. With home rental legal insurance, tenants can have access to a lawyer and protect their rights in case of any disputes or issues that may arise.

Legal insurance in Germany can be beneficial for landlords who reside in their own property and encounter legal disputes with their property management company. Home rental legal insurance can provide assistance in such situations, helping landlords navigate the legal complexities and protect their rights.

Neighbor Disputes

Legal insurance in Germany can provide protection for renters who may face disputes with their neighbors. Here are some examples:

Noise complaints.

Issues with shared spaces.

Use of an outdoor fire pit, which is causing disturbances.

Cooking on a grill.

Violations of “quiet time” (Ruhezeit)

Even if you might have a good relationship with your neighbor, social media platforms often highlight the various challenges that renters face with their neighbors, making legal insurance a valuable investment for those seeking protection.

Legal insurance in Germany can be a valuable investment for foreigners living in the country. While some rules and regulations may seem minor, they can add up and lead to unexpected legal issues.

Private Legal Insurance

Legal insurance can cover a variety of private contracts, for example:

Travel.

Purchases.

Hiring a handyman for home repairs or improvements.

Health insurance not covering your specific treatment.

Receiving a defective product after an online purchase

Professional Legal Insurance (Arbeitsrechtsschutz or Berufsrechtsschutz)

Legal insurance in Germany can provide coverage for job-related disputes, for example:

Conflicts with an employer or co-worker.

Protection for employees who are wrongfully terminated from their jobs. This can be especially important in a country like Germany, where labor laws are strict and employers are required to have a valid reason for terminating an employee's contract.

Negotiating severance packages for better terms and taking legal action if necessary.

Legal insurance can provide assistance if you are denied vacation days by your employer.

Legal protection for receiving a negative letter of recommendation from an employer. According to German law, employees have the right to receive a positive letter. This can be especially important for individuals seeking new employment opportunities, as a negative letter of recommendation can have a significant impact on their future career prospects.

Protection for individuals who are not getting paid for their work.

Purchase of Real Estate

Legal insurance in Germany can provide valuable protection for those purchasing a home. With this type of insurance, a lawyer can review the purchase contract to ensure that it is fair and legally binding. Additionally, legal insurance can provide coverage in the event that the seller tries to increase the price after the contract has been signed or if there are hidden defects in the property that were not disclosed prior to purchase.

For those who own investment properties in Germany, it is advisable to obtain legal insurance that specifically covers rental properties. This type of coverage is typically separate from personal legal insurance. Adam Riese is one insurance company that offers the option to add this specialized coverage to your policy.'

Interested in buying a home in Germany? Read our first-hand guide here of how to do it!

Internet Protection

Legal insurance can provide coverage for a variety of situations, such as identity theft or unauthorized use of personal information. It can also protect against privacy violations, such as the unauthorized publication of photos or personal information on the internet.

‘E-protection’ is something that Feather will cover, which can delete negative comments about you found online and seek damages.

Disputes with Authorities

Legal insurance can be helpful in a variety of situations with German authorities, for example:

Legal dispute over a fine or when you disagree with a tax assessment from the tax office.

Home Rental Legal Insurance

Home rental legal insurance typically covers a range of areas, including:

Dispute with the landlord, as also covered above.

Neighbor disputes, such as property disputes or noise complaints

Renting issues, such as heating or presence of mold

If you’re renting a home or a flat, legal insurance can leave you rest assured that your rights will be protected if something does not go your way.

Criminal law protection

In Germany, Legal insurance can provide coverage in the event that you are accused of a negligent offense. This type of insurance can help cover the costs of legal representation and other expenses associated with defending yourself in court. It can provide peace of mind and financial protection in case of unexpected legal issues.

Other legal support

Legal insurance in Germany can provide assistance in various situations, such as when you are a victim of a crime or when you suffer an injury due to someone else's negligence. In such cases, your legal insurance can help you pursue compensation and enforce your legal rights. For instance, if a flowerpot falls on you and causes you to lose your earnings, your legal insurance can support you in seeking damages for the harm caused.

What does Legal Insurance Not Cover?

In Germany, legal insurance is designed to cover the costs of legal expenses, including court and lawyer fees. However, it's important to note that legal insurance does not cover these items:

Any fines or compensation for damages that you may be required to pay.

Basic legal insurance plans typically do not cover the costs associated with divorces. If you require coverage for divorce-related legal expenses, you should check with your provider to see if they offer an add-on that can be purchased separately.

Pre-insured Acts, such as things that happened before you took out your policy.

If someone sues you for damages which you caused, this will not protect you from the costs. Liability insurance will cover you, which is the most recommended type of supplementary insurance in Germany.

Immigration challenges are not covered in most cases.

Piracy is not covered. If you pirate movies, don’t expect support.

Theft and intentional crimes are not covered.

Fines are not covered. Legal protection can reduce the fine you will pay at the end. For example, legal insurance will not pay for your speeding ticket.

In most cases, private legal insurance will not cover your business activities. You will need Gewerberechtsschutzversicherung for that.

Important Things to Consider About Legal Insurance

Waiting period

Some Legal insurance plans include a waiting period of two to three months before policyholders can make use of their coverage. This is to prevent customers from taking out insurance only when they anticipate trouble and the associated costs. By implementing a waiting period, insurance providers can protect themselves from potential losses and ensure that their policies remain sustainable over time. However, this is not everyone.

Sometimes there is a deductible or excess that the policyholder must pay before the insurer covers the remaining costs. However, some insurance providers offer a bonus to incentivize policyholders to remain claim-free throughout the year, which can help reduce the excess amount.

Feather, for example has an Advanced plan with little to no waiting period.

How Much Does Legal Insurance in Germany Cost?

In Germany, legal insurance typically ranges from €15 to €35 per month. However, the exact cost of your policy will depend on various factors, such as the size of your policy and your individual circumstances.

Go here to get a quote at Feather.

Click here to get a quote at Getsafe

Go here to get a quote from Adam Riese.

How Much Does a Lawyer in Germany Cost?

While the fee structure for legal experts is regulated, lawyers still have some discretion in determining costs based on the complexity of the case. For instance, a dispute involving 1,000 euros could result in lawyer fees of around 114 euros, with court fees ranging from 120 to 500 euros.

This means that total legal expenses could range from 234 to 614 euros, making legal insurance a valuable safeguard for unexpected legal costs. The costs of going to court could then grow into the thousands of euros.

What is the Best Legal Insurance in Germany?

If you're looking for legal insurance in Germany, it's important to know that not all insurance companies offer coverage for legal disputes. To help you make an informed decision, we've researched and compared the top three legal insurance providers in Germany. By weighing the benefits and drawbacks of each provider, you can find the one that best fits your needs.

Source: Getsafe.

GetSafe

Founded in 2015, Getsafe is a revolution in the German insurance industry, offering a convenient and hassle-free way to purchase insurance online. One of their offerings is legal insurance, which includes private, professional, and traffic legal protection starting at just €15.12 per month. Customers also have the option to add home legal protection and criminal protection to their package for added peace of mind.

Getsafe Pros

GetSafe offers a range of benefits, including unlimited maximum cover, the freedom to choose an English-speaking lawyer, and worldwide coverage for up to 12 months.

Additionally, there is a free 24/7 hotline for legal consultation, and both the website and customer support are available in English. The policy also includes a CleanFact Sheet in English outlining what is covered, and you have the option to cancel at any time.

The deductible is reduced by 100 euros each year without a claim, and self-employment work is covered up to 17,500 euros in annual turnover. In the event of needing to pay bail, an interest-free loan of up to 200,000 euros is possible, and you can easily add your family to the plan.

Getsafe Cons

Getsafe legal insurance typically comes with a deductible of €300 in the first year, which can increase to 500 euros after a claim.

Additionally, there may be waiting periods of up to 6 months depending on the specific legal area. It's important to carefully review the terms and conditions of any legal insurance policy before signing up to ensure it meets your needs and budget.

Click here to get a quote at Getsafe

Source: Feather.

Feather

Feather, a Berlin-based insurance broker, specializes in providing insurance services to expats and immigrants in Germany. Their services are offered in English and are 100% digital. Legal insurance is one of the packages offered by Feather, starting at €17.75 per month, which includes coverage for private, professional, traffic, and home insurance.

For those who anticipate legal issues in the near future, an advanced package is available, which reduces the waiting period in some cases. Here is what’s covered:

Source: Feather

Feather Pros

Feather legal insurance offers a range of benefits, including unlimited maximum cover (in Germany) and the freedom to choose an English-speaking lawyer. With worldwide coverage and a free initial legal consultation in English, you can feel confident in navigating legal issues in Germany.

Both Basic and Advanced covers provide protection in all four main areas, and there is a one-month cancellation period. Additionally, the deductible reduces each year without a claim, and advanced cover can even reduce waiting times for certain cases. Customer support and the website are also available in English for your convenience.

Feather Cons

It’s important to note that the terms and conditions are only available in German. Additionally, there is a deductible of 300 euros in the first year, which can increase to up to 500 euros after a claim. It's important to carefully review the terms and conditions before purchasing legal insurance in Germany.

Go here to get a quote at Feather.

Source: Adam Riese. Translated by Google Translate.

Adam Riese

Adam Riese, a digital insurance provider based in Stuttgart, Germany, offers legal insurance starting at just €14.84 per month. Founded in 2017 as part of the Wüstenrot & Württembergische AG group, Adam Riese aims to digitize their products and make insurance more accessible to customers. With Adam Riese's legal insurance, customers can customize their coverage to fit their needs and choose the areas they want to have covered.

Adam Riese Pros

This very popular legal insurance option is the least expensive of the three and can be customized to best fit your needs. You can pay for what you need.

Adam Riese Cons

Adam Riese legal insurance may have some limitations for non-German speakers. The website and customer service are only available in German, and the free hotline for legal consultation is also in German. Additionally, there may be a waiting time of up to three months for non-traffic cases.

Go here to get a quote from Adam Riese.

Cheaper Alternative Options to Legal Insurance

If you’re a tenant looking for support for your rental, you can use a service called Conny or reach out to a tenant association (Mieteverein).

If you have a low income, you can reach out to your local Amstgericht to apply for legal help (Beratungshilfe.) You will receive a certificate (Beratungshilfeschein) that pays your legal costs. If you get ALG II or Socialhilfe or an asylum seeker, you’re eligible. German speaking is often required for this assistance.

How to File a Legal Claim in Germany

Contact your insurer

First, you will need to contact your legal insurer and obtain a cover note (Deckungszusage). This is a confirmation that the legal costs will be covered. Your lawyer can get this, or you can yourself, which will take up to 2 weeks. It’s important to obtain this document because your insurance my refuse to cover you if they don’t think you will win.Choose your lawyer

Your legal insurance will let you choose a lawyer, or they will recommend one. Sometimes the recommended lawyer will result in a lower deductible (Selbstbeteiligung.) You can always choose the lawyer. Your insurance can also recommend a lawyer.First consultation

Once you’ve picked out your lawyer, set up a consultation. The first consultation (Erstberatung), the lawyer will listen to your problem and provide next steps.Begin problem solving

Once you have confirmation your insurance will pay, you’ve chosen a lawyer and had a first consultation, the next steps will get underway to solve your legal issue.

Final Thoughts: Why Everyone Should Consider Investing in Legal Insurance

Navigating the legal system in a foreign country can be daunting, especially for expats and immigrants in Germany. To avoid any potential misunderstandings or legal issues, many expats opt for legal insurance. With this insurance, expats and immigrants can have peace of mind knowing that they have access to legal assistance and support when they need it.

If you're considering legal insurance in Germany, it's important to find the right insurance company for your needs.

For those seeking legal insurance in Germany, Feather's comprehensive advanced policy offers English-language support and minimal waiting periods. Getsafe is very simple and the app-based interface is extremely convenient. However, Adam Riese is also a reliable and flexible option for those comfortable with German.

Regardless of which option you choose, having legal insurance can provide peace of mind and protection in case of unexpected legal issues.

Go here to get a quote at Feather.